The Future Takes Flight: How UAV Technology is Transforming Defense and Commercial Operations

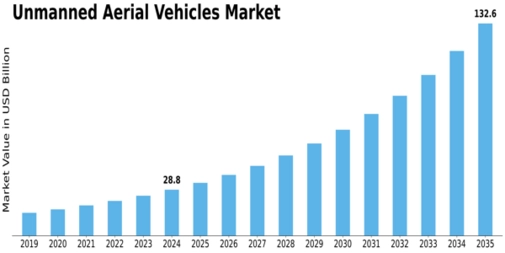

The UAV industry is currently riding a wave of transformative growth, marked by a robust adoption curve across defense, commercial, and civil spheres. According to MRFR, the global UAV market is valued at USD 28.8 billion in 2024, and is expected to expand to USD 132.4 billion by 2035, translating into a compound annual growth rate (CAGR) of 14.89 % over 2025–2035.

Drivers of Growth

- Technological innovation

Advances in AI, computer vision, sensor miniaturization, and battery technologies are enhancing UAV autonomy, endurance, and payload capabilities. These technical gains reduce human oversight and make drones more capable for diverse applications. - Regulatory evolution and policy support

Governments globally are evolving frameworks to integrate UAVs safely into airspaces, thereby easing adoption barriers. This regulatory clarity gives confidence to investors and operators. - Commercial application expansion

UAVs are transforming sectors such as agriculture (crop monitoring, precision spraying), logistics (last-mile delivery), infrastructure inspection, mining, and media. Cost savings, operational efficiency, and access to difficult terrain drive uptake. - Security, surveillance & defense demand

Military and public authority sectors remain critical adopters of UAVs—especially for ISR (intelligence, surveillance, reconnaissance). Border monitoring, disaster response, and homeland security needs further stimulate demand.

Growth Challenges

- Energy / endurance constraints: Battery capacity and energy efficiency remain limiting factors, especially for longer-range or payload-intensive missions.

- Airspace integration complexity: Safe coexistence with manned aviation, especially for Beyond Visual Line of Sight (BVLOS) operations, demands robust standards and infrastructure.

- Competitive pressure & consolidation: Intense rivalry, frequent M&A activity, and regulatory risks require firms to constantly innovate and scale.

Growth by Segment

- The multicopter (rotary-wing) segment dominates in 2024, valued for agility, stability, and ease of deployment, especially for close-range tasks.

- Among propulsion types, electric UAVs lead due to lower noise, emissions, and operating costs; but hybrid systems are forecasted to grow fastest, combining the advantages of batteries and combustion / fuel-based extended range.

- In weight classes, the 0.25–25 kg bracket is dominant and fastest growing—this is the sweet spot for commercial, industrial, and light-delivery applications.

- Range-wise, Extended Visual Line of Sight (EVLOS, 500 m–2 km) currently holds lead share, while BVLOS (Beyond 2 km) is projected to grow fastest as communications, autonomy, and regulation mature.

- In terms of operational mode, remotely & optionally piloted systems are the present norm, but fully autonomous UAVs are forecasted to gain ground as AI and navigation systems improve.

Outlook

Given strong tailwinds across technology, policy, and demand, the UAV market is poised to enter a sustained phase of growth. But realizing full potential will depend on overcoming regulatory, energy, and integration challenges. For companies and investors, success lies in targeting fast-growing segments (hybrid propulsion, BVLOS, autonomy) and applications (logistics, surveillance, agriculture).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness